Sebulan terakhir, Indonesia mengalami minggu yang membingungkan. Ratusan orang turun ke jalan di Jakarta dan beberapa kota lain menyuarakan kekecewaan atas rencana pemerintah untuk memangkas subsidi bbm, efek dari pemangkasan itu adalah naiknya harga bbm tipe Ron-88 atau premium dari Rp4500 ke Rp6000. Perlu diingat pada tahun 2008 sampai 2009 harga premium sudah menyentuh Rp6000.

Keputusan anggota dewan Indonesia yang memungkin harga bbm naik dengan alasan kenaikan harga minyak dunia sangat menyesatkan, bukan hanya karena menggantungkan harga bbm kepada Petropolitik global tapi juga menyisihkan alasan-alasan domestik mengenai pentingnya memotong subsidi bbm. Alasan yang saya maksud bukan hanya masalah kesehatan APBN atau atau kesalahan alokasi subsidi. Saya ingin mengajukan beberapa alasan yang menurut saya krusial mengenai pemotongan subsidi bbm. Objective saya adalah menolak Negara memberi subsidi se-sen-pun untuk bbm (minyak fossil), dengan lima alasan yang akan saya uraikan berikut ini.

Pertama, bbm atau bahan bakar fosil merupakan tipe bahan bakar paling bermasalah, bukan hanya karena keterbatasannya, tapi juga efeknya terhadap lingkungan hidup. Tanah dalam radius lebih dari 5km yang dilewati oleh sumur pengeboran akan kehilangan C-organik (humus) yang berfungsi untuk menjaga kesuburan tanah. Setiap pengeboran memiliki resikonya sendiri terhadap lingkungan hidup, pengeboran lepas pantai juga membahayakan ekosistem laut dan pantai. Di Indonesia Agripolitik lebih kuat daripada Petropolitik sehingga membahayakan agrikultur demi minyak adalah fitnah terhadap identitas nasional. Menambah kilang minyak didarat akan membunuh produktivitas lahan pertanian, karena itulah kita harus berpikir ulang untuk menambah kilang terutama di darat.

Kedua, bbm tipe ron-88 memiliki jumlah polutan yang paling ganas, mengandung Logam pb (timbal), Merkuri dan SO4. Paska 1998 jumlah penderita hipertensi, kanker paru-paru, ganguan pernapasan meningkat drastis (belum termasuk penyakit lain yang disebabkan timbal, seperti kanker). Emisi kendaraan bermotor telah menyebabkan polusi udara sampai 70% di Jakarta dan beberapa kota besar. Dibawah ini adalah kue polusi di Jakarta yang dikeluarkan Pemda DKI pada 2010.

Ketiga, kemajuan ekonomi telah menyulut pasar otomotif. Saya akan menggunakan kurva 2004 karena setelah tahun itu penggunaan kendaraan bermotor terus meningkat 10% sampai 15% pertahun. Pengunaan bbm oleh kendaraan bermotor “menggila” setelah 2004.

Karena murahnya harga bbm penggunaan kendaraan bermotor cenderung tidak efektif, pemborosan terjadi dari tahun ke tahun. Sementara sumur yang bisa dobor semakin sedikit, karena ada beberapa kilang yang terlalu beresiko untuk di bor.

Tapi konsumsi bbm di Indonesia tidak sebanding dengan kemampuan perusahaan tambang untuk memproduksi bbm. Dibawah ini adalah perbandingan konsumsi bbm ron-88 (premium) dan produksi minyak mentah yang belum diolah.

Dibawah ini adalah chart forecast GDP negara Pasifik dari Citi Investment yang menaruh Indonesia dua inci di bawah India.

Kondisi membuktikan bahwa sektor swasta di Indonesia berkembang pesat, perkembangan ini akan meminta mendorong permintaan energi, bbm sebagai energi paling murah akan terus diperas, sementara kilang berkurang, kita akan berada di ambang krisis energi.

Keempat, murahnya harga bbm telah menghalangi perkembangan energi alternative yang ramah lingkungan seperti geothermal. Mengenai energy Geothermal: http://www.google.co.id/url?sa=t&rct=j&q=energi+geothermal+indonesia&source=web&cd=2&ved=0CDIQFjAB&url=http%3A%2F%2Fgeothermal.itb.ac.id%2Fwp-content%2Fuploads%2FSekilas_tentang_Panas_Bumi.pdf&ei=y4V4T-7fPInYrQeSiuWKDQ&usg=AFQjCNESw1OfE57fUn60saHwoWN1W3x2yQ

Dari file pdf diatas saya harap kita bisa melihat bagaimana mudahnya produksi energi geothermal, dan biaya operasionalnya sangat murah dibandingkan dengan sisa minyak mentah yang biaya lifting dan reproduksi semakin mahal. Perkembangan energi Geothermal sebagaimana energi alternatif lainnya menjadi lumpuh bukan hanya karena tidak adanya pengembangan dari pemerintah, tetapi karena energi dari bahan bakar fossil jauh lebih murah, sehingga menghalangi manuver pasar. Potensi Energi Geothermal kita terbesar di DUNIA! 30-40% energi panas bumi ada di Indonesia. Jawa sebagai pulau yang dipenuhi gunung aktif adalah lahan dari Geothermal. Tetapi Geothermal menjadi tidak masuk akal, karena dengan Rp4500 anda sudah mendapat 1 liter energi.

Kelima, Logika yang harus kita gunakan untuk minyak fossil adalah logika komoditi, kita harus memperkaya diri atas minyak fossil yang kita punya, menaruhnya pada standard jual minyal dunia yang sangat menguntungkan. Negara harus mampu mengalokasikan keuntungannya ke sektor vital seperti agrikultur, pendidikan, infrastruktur dan kesehatan. Bukan membiarkan minyak fossil digunakan secara tidak arif di pasar domestik. Satu dekade kedepan hanya minyak fossil dan gas bumi yang bisa menjadi lumbung uang bagi Indonesia, kita tidak seperti Jepang atau Jerman yang punya industri kuat, atau China dan India yang punya pasar buruh untuk produksi massal.

Memotong subsidi minyak fossil membuat kita bisa menyimpan Fund Trust lebih tinggi, untuk membayar hutang Negara yang sudah mencapai 1800T. Mengenai hutang Nasional lihat http://www.bi.go.id/web/en/Statistik/Statistik+Utang+Luar+Negeri+Indonesia/

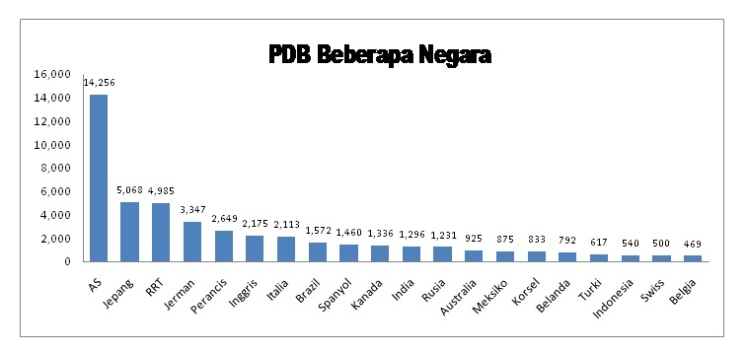

Apalagi ekonomi Indonesia sedang dalam puncaknya setelah 1998, ekonomi menguat karena visi dari sektor swasta bukan inisiatif pemerintah. Itu bisa kita lihat dari pendapatan negara sangat kecil, lihat tabel PDB beberapa negara per-satu juta USD dibawah ini:

Dari chart diatas Indonesia berada dibawah Turki dan diatas Swiss, dan itu sangat mengecewakan. Pendapatan nasional terbesar adalah dari ekspor energi, Indonesia tidak mendapatkan penghasilan yang mencukupi dari sektor pajak, Indonesia adalah negara yang paling sedikit memajaki rakyatnya. Berbeda dengan AS dan Jepang yang kaya dari pajak sektor swasta. Dengan menjadikan minyak fossil sebagai komoditi Indonesia bisa meningkatkan PDB sampai pada level 30% pada 2013.

Visi menaikkan harga bbm adalah menguatkan fund trust (kas pasif), massive-nya perkembangan ekonomi swasta telah membawa Indonesia pada kekuatan pasar domestik, orang yang hidup dengan $2 sampai $5 perhari jumlah 120 juta orang, kebutuhan akan bbm akan terus melonjak dan akan mencapai titik dimana kita harus mengimpor lebih banyak bbm. Itu berbahaya untuk ekonomi dan kehidupan sosial (kesehatan dll). Kalau tidak dinaikkan penggunaan bbm akan menjadi bom waktu di Indonesia.

Dari kelima alasan diatas, saya menarik kesimpulan bahwa menaikkan bbm adalah sebuah kebutuhan yang tidak terelakkan. Sementara kenaikan sebesar 30% atau Rp1500 adalah langkah yang masuk akal karena tidak akan mengubah struktur ekonomi, tapi akan merubah struktur etik penggunaan bahan bakar terutama untuk kendaraan pribadi, dengan kata lain orang akan menggunakan kendaraan bermotor dengan bijak, tidak boros. Dilain pihak industri kecil dan menengah akan bertahan dengan penyesuaian harga produksi, distribusi dan harga jual.

Tetapi saya sampai pada satu kekhwatiran bahwa pemerintahan SBY akan menggunakan kenaikan harga bbm ini sebagai alat politik, ada kemungkinan 2014 pemerintah akan menurunkan harga bbm untuk memenangkan pemilu, yang sudah mereka lakukan pada pemilu 2009. Lagipula belum ada satupun partai politik yang menjadikan pemberhentian subsidi bbm sebagai agenda politik. Bahkan PDI-P yang tadinya saya pikir akan mengutamakan sektor agrikultur malah bermain di politik bbm.

Kekhawatiran saya tidak selesai sampai disitu, pertanyaan berikutnya apakah pemerintah mampu untuk mengolah dana keuntungan dari pemotongan subsidi bbm lalu mengalokasikannya dalam kebijakan waras selain BLTS? Sementara kepercayaan rakyat kepada pemerintah yang tengah disorot kasus korupsi dan miss management sudah pada titik terendah. Kerendahan titik kepercayaan kepada pemerintah itulah yang menurut saya menjadi penggerak utama demonstrasi anti-kenaikan bbm, dengan kata lain alasan penolakan pemotongan subsidi bbm terletak pada kondisi psikologis bukan fakta bahwa secara ekonomi rakyat tidak siap, pada tahun 2008 dimana ekonomi swasta di Indonesia ikut digoyang oleh krisis kredit di Amerika, ekonomi tetap berjalan dengan harga bbm Rp6000. Keluwesan ekonomi rakyat sudah dibuktikan oleh sejarah, lagipula kenaikan Rp1500 tidak akan “meresahkan” pasar.

Ketergantungan pada subsidi bbm akan membunuh kita pelan-pelan, kita harus membuang sedikit-demi-sedikit subsidi bbm yang menyesatkan ini. Tentu ini adalah bagian dari sikap saya terhadap kebijakan energi di Indonesia, dan sikap ini tidaklah kaku sangat siap untuk berdiskusi dengan fakta dan nasihat.

Terimakasih.